The Stimulus Package

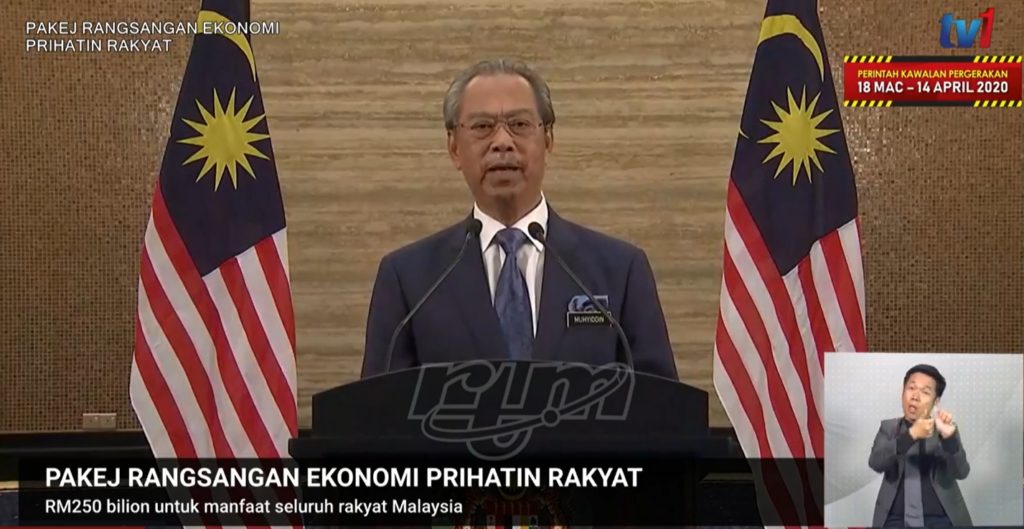

Yesterday, Muhyiddin Yassin announced a purported RM250 billion stimulus package to weather Malaysia through the Covid-19 pandemic’s devastating economic impact.

At the outset, let us be clear that the Government is not actually spending RM250 billion, but merely injecting RM25 billion. The balance RM225 billion actually comprises of the total value of EPF withdrawals (the citizen’s own retirement funds), waiver of rental payments for government buildings and utilities (the savings that citizens will enjoy), etc.

Muhyiddin made it clear in his speech:

“Kerajaan akan membuat suntikan fiskal langsung berjumlah RM25 billion untuk membantu mengurangkan beban rakyat dan pemilik perniagaan dalam mengharungi cabaran ekonomi yang sukar ini”

The billion dollar question (literally) is this: can the Federal Government spend RM25 billion through this stimulus package without passing a Bill in Parliament?

Public Financing Under the Federal Constitution

Under Article 97 of the Constitution, all revenues and raised and received by the Federal Government shall be paid into and form one fund: the Consolidated Fund.

The Consolidated Fund is, for all intents and purposes, the main purse of the Federal Government.

But just because it is your purse, doesn’t mean the Federal Government can spend however it wants from it carte blanche.

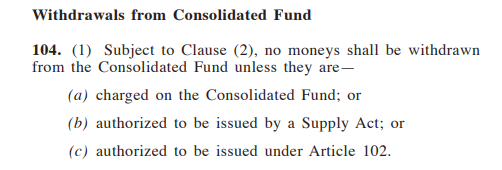

Our Constitution has made it very clear that monies from the Consolidated Fund can only be withdrawn under 3 scenarios. Article 104(1) reads:

Let us examine each of these 3 scenarios sequentially.

Expenditure “Charged” On the Consolidated Fund

In essence, expenditures “charged” on the Consolidated Fund are ones which are specifically earmarked for under the Constitution. These are mostly remuneration for important and independent public servants. Some examples include:

(1) Remuneration of the YDPA & Timbalan YDPA (Art 35)

(2) Remuneration of the President and Deputy President of the Dewan Negara, as well as Speakers and Deputy Speakers of Dewan Rakyat (Art 58)

(3) Remuneration of the Auditor-General (Art 105)

(4) Remuneration of members of the Election Commission (Art 114

(5) Remuneration of superior court Judges (Art 125)

(6) Grants to States (Art 109)

(7) All pensions, compensation for loss of office and gratuities which the Federation is liable (Art 98(1)(a))

(8) All debts which the Federation is liable (Art 98(1)(b))

(9) Any moneys required to satisfy any judgment, decision or award against the Federation by any court or tribunal (Art 98(1)(c))

Evidently, Muhyiddin’s stimulus package does not fall under this category.

Expenditure Issued by a Supply Act

Supply Acts are your quintessential (and much anticipated) annual budget speeches read out by the Minister of Finance and passed by Parliament. These bugdets will contain a detailed breakdown of the expenditures for specific Ministries or purposes for a particular financial year. An example would be Lim Guan Eng’s Budget 2020 to the sum of RM173,136,214,600.

Under Article 101 of the Constitution, if the Federal Government finds that the Supply Act for that financial year is insufficient or there additional matters necessary to spend on, it must table a Supplementary Supply Bill in Parliament.

For example, the Pakatan Harapan Government tabled a supplementary supply bill seeking an additional RM4.133 billion for the federal budget in March 2019.

Muhyiddin’s stimulus package is not part of Budget 2020, which is the latest Government budget. Neither has there been a Supplementary Supply Bill been tabled in Parliament (which has been delayed until 18th May 2020 by Muhyiddin pursuant to his powers as Prime Minister).

Expenditure Authoritised Under Article 102

Article 102 is designed to address the need to spend money in unusual circumstances where strict adherence to table comprehensive Supply Bills or Supplementary Supply Bills can be waived.

In gist, under Article 102, Parliament has the power in any financial year to:

(1) Authorise by law expenditure for that financial year before the passing of the Supply Bill; or

(2) Authorise by law expenditure for the whole or part of that financial year without going through, among others, the Supplementary Supply Bill under Article 101, if “owing to the magnitude or indefinite character of any service or to circumstances of unusual urgency it appears to Parliament to be desirable to do so”

To my knowledge, there has not been an Act passed by Parliament pursuant to either of those circumstances. Muhyiddin’s stimulus package therefore cannot find legal refuge under Article 102.

The drafters of our Constitution have explicitly acknowledged that, in a national crisis of unusual urgency, the Federal Government can dispense with a detailed Supplementary Supply Bill and instead pass a simple Bill instead to authorise any required expenditure.

Why then has the Federal Government not utilised Article 102 to convene for an emergency sitting in Parliament to pass this stimulus package?

Contingency Funds?

The only other source of funds which could be constitutionally withdrawn by Muhyiddin for the RM25bil fiscal injection is the Contingency Fund established under Article 103 of the Constitution.

Parliament is authorised to create a Contingency Fund, which can be tapped by the Minister of Finance if there has arisen an “urgent and unforeseen need for expenditure for which no other provision exists”. But if advances are withdrawn from the Contingency Fund, a Supply Bill must be introduced as soon as possible in Parliament to replace the amount so advanced.

However, under Budget 2020, only RM 2 billion is reserved for the Contingency Fund. This hardly covers the RM 25 billion projected to be spent by Muhyiddin.

Private Finance Initiatives?

Some (who are better trained in finance than a lawyer) have suggested that Muhyiddin and the Minister of Finance may be leveraging on some kind of private finance initiative (PFI) to fund the RM 25 billion. In short, a PFI is a procurement method which utilises private sector investment to deliver public sector services.

This is not unusual given the presence of gargantuan GLCs in the Malaysian corporate sector. The legality of such measures – which arguably bypasses parliament scrutiny on Government expenditure – can also be questioned.

But all this is mere speculation at the moment – we will have to wait and see if a PFI has been adopted.

The Value of Parliamentary Scrutiny on Budgets

No doubt the Covid-19 outbreak is unprecedented in modern history. And an urgent fiscal package must be introduced immediately to jumpstart the economy, save jobs and help the rakyat survive this terrifying pandemic.

But there is great value in having Opposition (as well as Government backbencher) input and scrutiny over any Government stimulus package.

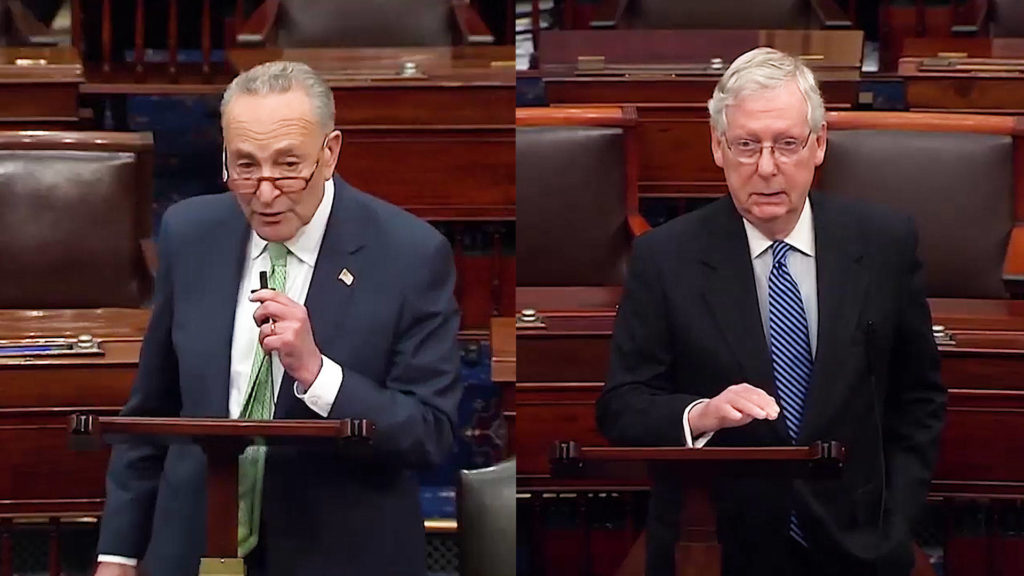

Modern democracies such as the US, Canada and even neighbouring Singapore have tabled their stimulus packages for Covid-19 in their Houses of Representatives.

Democrat Senators in fact bargained for additional provisions to be inserted in the US’ historic USD 2 trillion stimulus package, which most opined have enhanced the effectiveness of the same.

We must also not ignore the Constitution. Our forefathers and the drafters of our Constitution have envisioned Parliament to be the main organ to oversee Federal Government expenditures.

We must adhere to these constitutional safeguards of Parliamentary accountability and bipartisanship cooperation in public finance – not in spite of, but more so in a time of national crisis such as Covid-19.